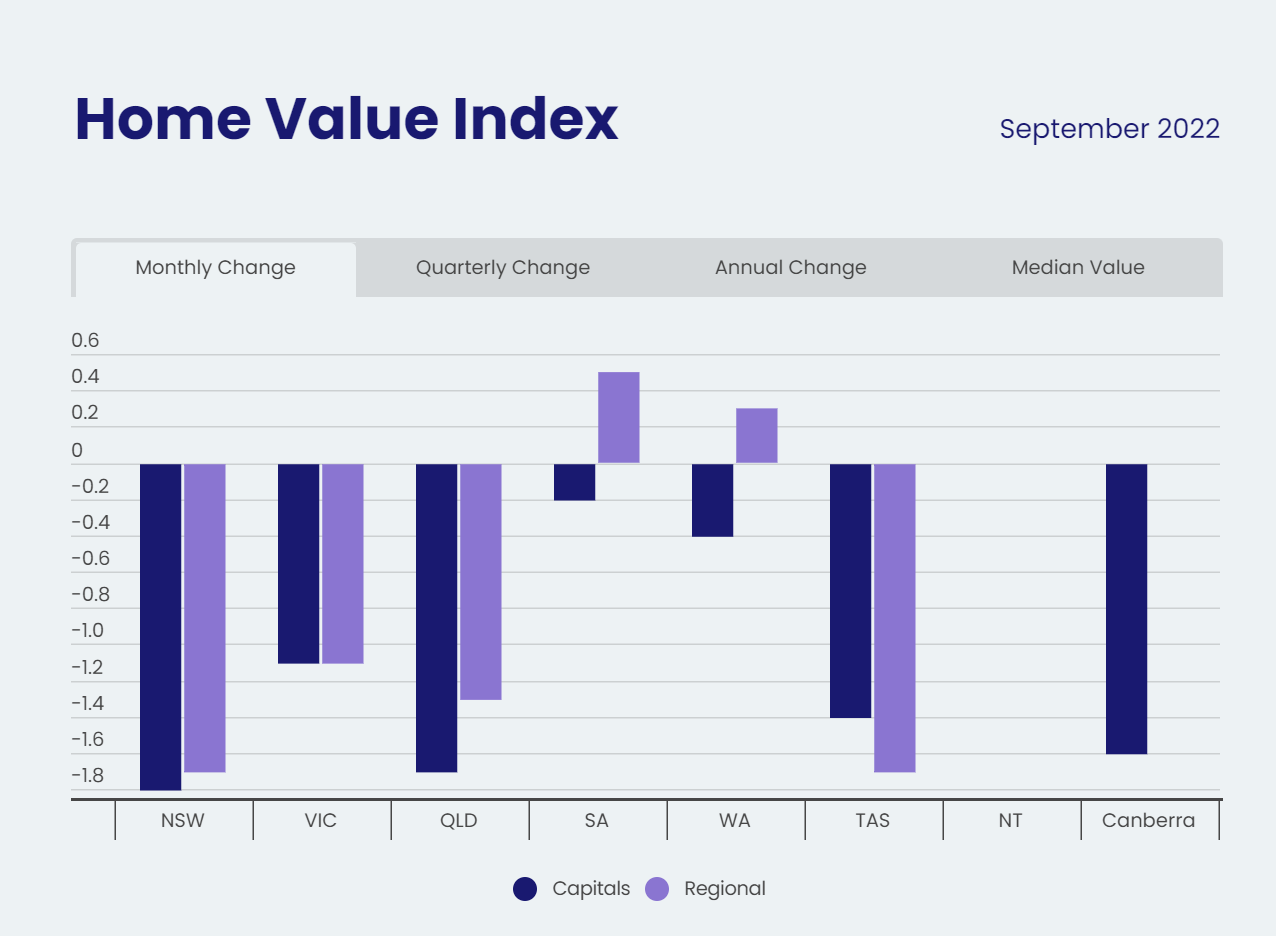

Property prices continued to fall in September, but homeowners may be set to get a reprieve according to CoreLogic’s Home Value Index. The Index reveals that the rate of decline eased from 1.6% in August to 1.4% during the first month of spring.

The slowdown was apparent in all the capital cities, except for Adelaide and Perth where rates of decline accelerated compared to the previous month. However, both cities continue to record only a slight decrease in prices (0.2% and 0.4% respectively). Regional areas in South Australia and Western Australia are the only housing markets showing growth.

In Sydney, the monthly rate of decline eased from 2.3% in August to 1.8% in September. Brisbane’s rate of decline fell from 1.8% to 1.7%, while Melbourne’s eased from 1.2% to 1.1%.

Darwin is the only capital city where housing values are remaining steady, although they continue to be 10.1% below the city’s 2014 peak.

Figure 1: Monthly change in home values for September 2022

Source: CoreLogic Home Value Index, October 2022

While the easing rate of decline is positive news for homeowners, CoreLogic’s research director, Tim Lawless, cautions against assuming the housing market has come through the worst of the downturn.

“It’s possible we have seen the initial shock of a rapid rise in interest rates pass through the market, and most borrowers and prospective homebuyers have now ‘priced in’ further rate hikes,” he says. “However, if interest rates continue to rise as rapidly as they have since May, we could see the rate of decline in housing values accelerate once again.”

CoreLogic also noted improvement in several other key indicators during September.

“Auction clearance rates also trended upwards, albeit subtly, in September, and consumer sentiment nudged a little higher as well on the back of strong labour market conditions,” Lawless said.

Michael Yardney, director of Metropole Property Strategists, believes there are “early signs that the market is looking for a bottom”.

“Auction clearance rates have risen to the highest levels since May despite more properties being offered for sale and another rise in interest rates,” he said. “With inflation forecast to peak in coming months, it’s possible our housing markets could move back into positive territory early next year,” he said.

Values are falling but many homeowners are still ahead

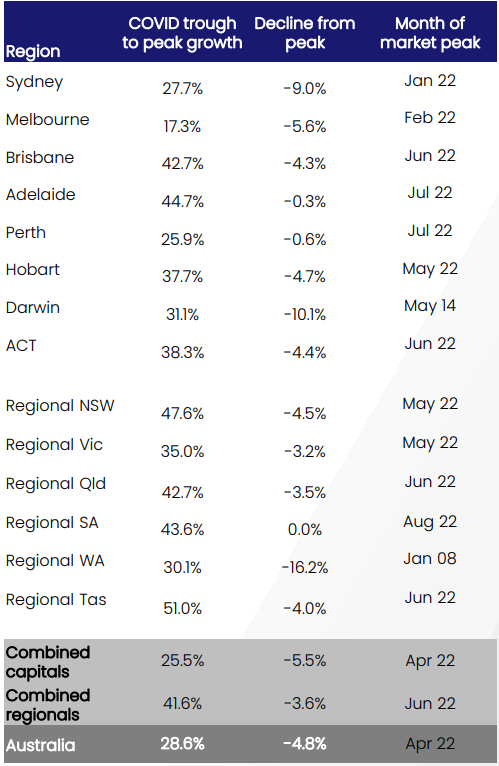

After rising 25.5% during the recent growth cycle, capital city housing values are now 5.5% below the recent peak. Regional values, which recorded stronger growth conditions through the upswing (41.6%), are down 3.6%.

Despite this, many homeowners continue to have a substantial buffer between current housing values and where they were at the beginning of the COVID-19 pandemic in March 2020.

Looking at the capital cities’ combined figures, housing values would need to fall another 13.5% before wiping out the gains of the recent growth cycle.

Figure 2: Housing values in the capital cities and regions since the beginning of the pandemic

Source: CoreLogic Home Value Index, October 2022

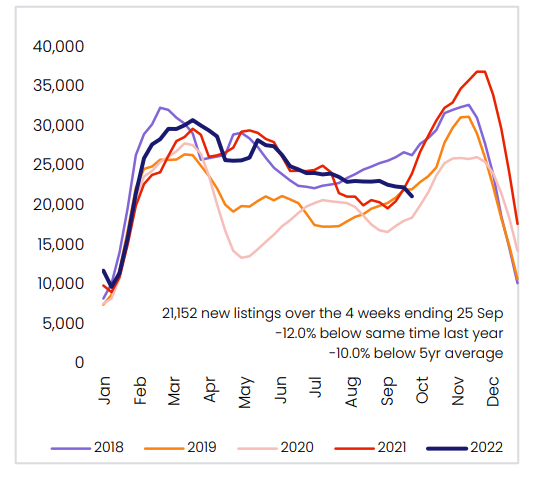

Slow start to Spring as vendors hold back new listings

A fall in the number of fresh listings added to capital city housing markets during September – which is when the market normally starts to ramp up again after winter – may be a factor behind the easing rate of decline in housing prices.

According to CoreLogic, the number of new listings in capital city markets during the four weeks to 25 September was 12% lower than the same period in 2021 and 10% below the previous five-year average.

While the mortgage ‘cliff’ many homeowners face when low fixed-rate loans secured during the pandemic start to expire next year may see many sell up, Lawless says he hasn’t seen any evidence of distressed sales or panicked selling through the downturn to date.

“It seems prospective vendors are prepared to wait out the housing downturn, rather than try to sell under more challenging market conditions,” Lawless said.

Figure 3: New listings in Australia’s capital cities, shown as a rolling 28-day count

Source: CoreLogic Home Value Index, October 2022

While property market conditions have undoubtedly changed since the market peaked earlier this year, PropTrack Economist Angus Moore believes it is “too soon to be able to draw firm conclusions” about how the market will fare during spring.

“Looking further ahead, the fundamental drivers of demand remain strong, with unemployment very low, wages growth expected to pick up over this year, and international migration increasing,” he said.